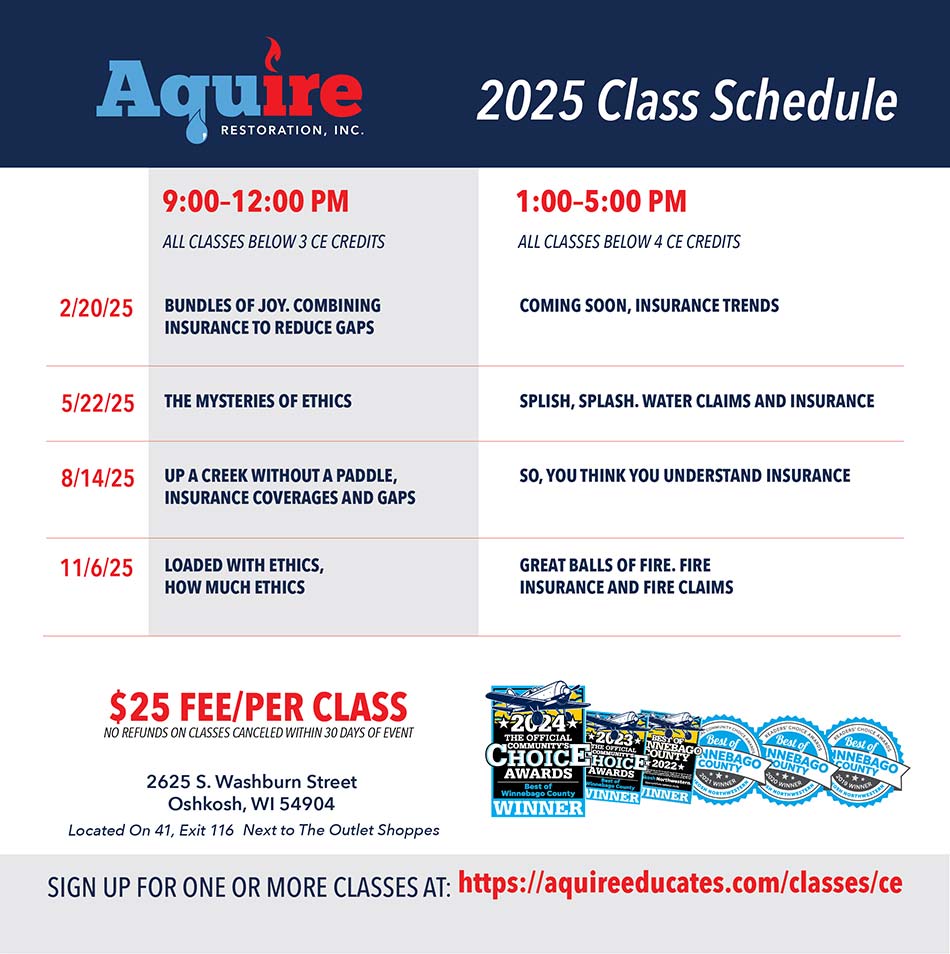

Each Course Requires Separate Registration.

Two Courses per Day - AM Course is 3 CE's and PM Course is 4 CE's. Resgister for AM, PM or Both

Registration is not confirmed until PayPal/Debit/CC payment is processed - Registrations are first-come, first serve until max allotment is full.